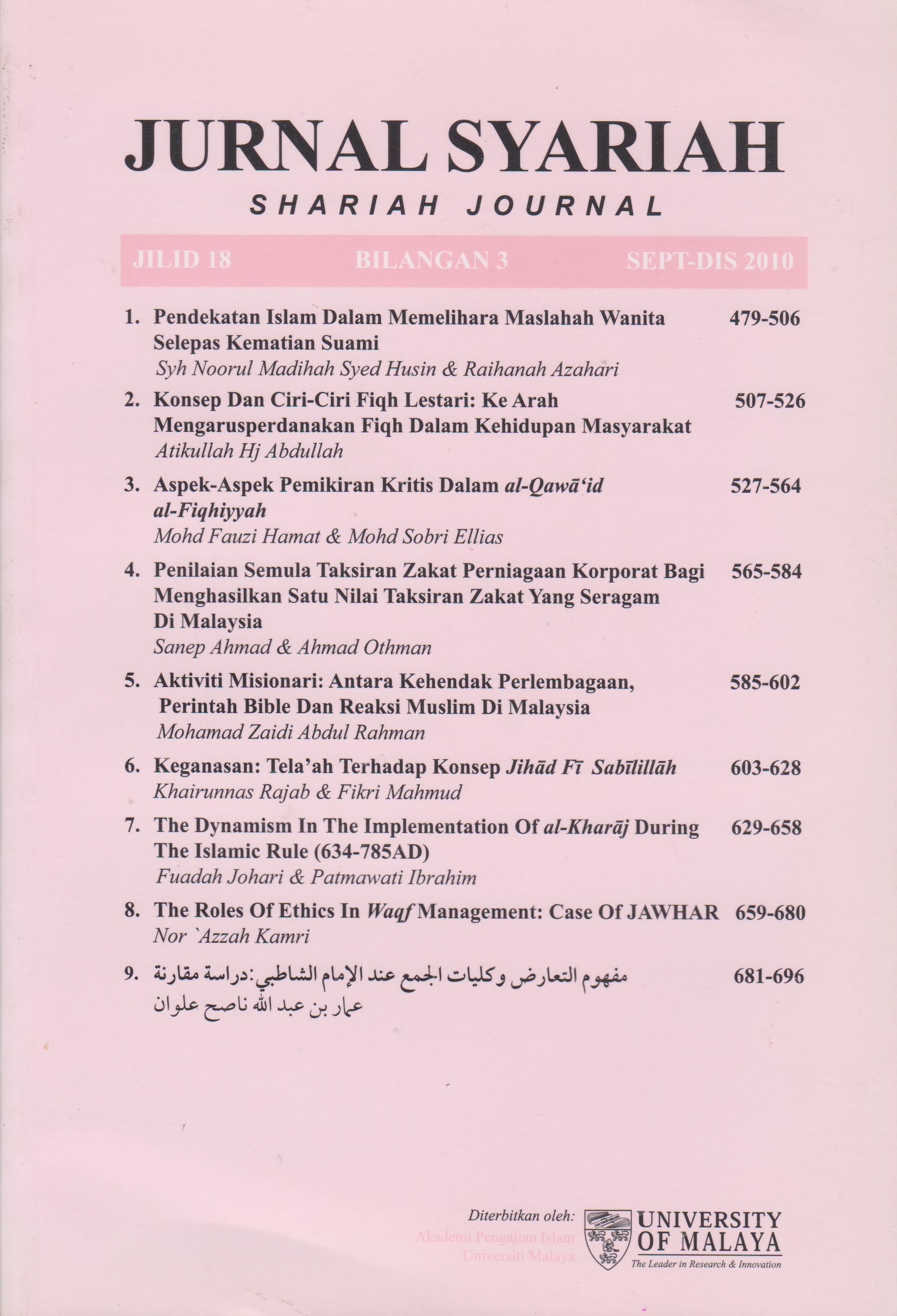

PENILAIAN SEMULA TAKSIRAN ZAKAT PERNIAGAAN KORPORAT BAGI MENGHASILKAN SATU NILAI TAKSIRAN ZAKAT YANG SERAGAM DI MALAYSIA

Keywords:

zakat accounting, business zakat assessment, financial debts, materials debts, raw material inventory, finished goods inventoryAbstract

Although JAKIM introduced a business zakat assessment method to be used by zakat centres and the public, the suggested method raises several questions relating to the account of debts and business inventories, which result in a different amount of zakat assessment. Therefore, questions related to debts and inventories in the zakat assessment method need to be re-examined. Thus, this paper attempts to examine the method of zakat assessment, identify the causes of the problem of different amounts of zakat assessment and further analyze possible ways for achieving a consistent, fair and standardized assessment method. The study found that treatment of debts and inventories were inconsistent and that financial debts and commodities debts for the case of debts and raw material inventories and finished goods inventories were treated inconsistently. In order to achieve a consistent and standardized zakat assessment method that would result in a similar amount of zakat, it was suggested that treatment should be consistent for both items. Financial debts for operation should be treated in the same way as goods debts. Similarly, raw material inventory and semi-products inventory should be treated consistently with finished goods inventory. An important implication from this study is that the business zakat assessment policy needs to be consistent concerning whether or not to allow deduction for both the cases of debts and inventories accounts.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

COPYRIGHT: All rights reserved. Not allowed to be reproduced any part of articles and contents of this journal in any form or by any way, whether electronic, mechanical, photocopying, recording or otherwise without permission in writing from the Chief Editor, Jurnal Syariah.